Messari Report Analysis: Memecoin Trading Volume Accounts for Over Half, Can Solana's Growth Myth Continue?

Original Author: MONK

Original Translation: DeepTech TechFlow

Lately, the debate over whether Memecoin is "dying" and if this will put Solana in trouble has escalated. Next, I will use data to provide you with an answer.

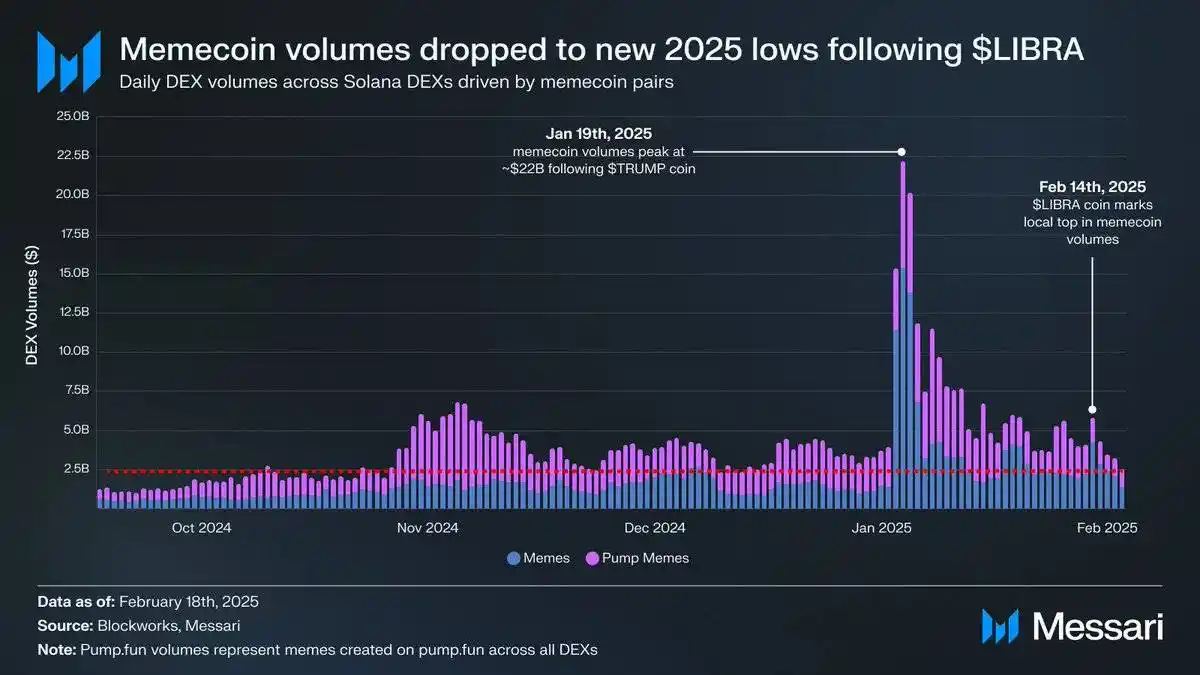

Since the $LIBRA event, Memecoin trading volume on Solana has dropped to the lowest level this year.

However, it is important to note that the current volume is still higher than at the beginning of 2024, indicating that Memecoin has not yet exited the stage of history.

What I really want to emphasize is the extent to which the Solana economy relies on Memecoin support.

Solana's Economic Dependence on Memecoin: Risks and Current Situation

Solana's economy is fundamentally driven by transaction volume.

If we look at the leading applications ranked by revenue on Solana, we will find that these applications are almost all protocols that in some way facilitate transaction activity.

This can be validated by the strong correlation between daily DEX trading volume and application revenue.

This pattern is not uncommon in today's high-throughput blockchains. For example, Base's economy also largely operates based on transaction volume.

In contrast, Ethereum's mainnet revenue comes more from applications driven by Total Value Locked (TVL), such as lending and mining rewards, mainly because transaction activity on the mainnet has significantly reduced.

However, it is important to note what drives this transaction volume.

On Solana, a significant amount of trading activity comes from Memecoin.

But what is concerning is that the proportion of Memecoin's trading volume has become abnormally high. For example, in February 2025, Memecoin's trading volume accounted for 70% of the total Solana DEX trading volume.

In contrast, Solana's competitor Base is gradually reducing its reliance on Memecoin trading volume and shifting towards more project tokens and trading pairs denominated in mainstream assets:

Why is this an issue?

Firstly, Solana's Memecoin volatility is extremely high, and the sustainability of these Memecoins is still in question.

More importantly, researchers, investors, and the Solana Foundation have been emphasizing the growth of application revenue and "on-chain GDP." Solana's application revenue has indeed been growing rapidly and remains one of the key metrics of user activity.

However, when we delve into the primary sources of this revenue, we find that the most profitable businesses on Solana are actually those profiting from Memecoin reliance.

For example, the two highest-earning areas on Solana are Telegram trading bots and Launchpads (such as pump.fun).

These two areas together contribute to over 60% of Solana's application revenue, with an annualized income exceeding $33 billion.

The core of these businesses is indeed Memecoin.

The interdependence in Solana's app economy further exacerbates the risk of Memecoin trading volume.

For instance, Pump relies on Raydium, Raydium relies on Jupiter, followed by Photon and Jito.

This means that a Memecoin transaction can generate revenue for five different apps simultaneously.

Therefore, these seemingly independent business apps are actually significantly interdependent in terms of revenue.

However, this cross-domain revenue is all built on the foundation of current 50%-70% of transaction volume originating from Memecoin activity.

From a blockchain perspective, Memecoin itself is not the issue. For Solana, this phenomenon is a natural outcome of its low-cost block space and early lead in on-chain user experience (UX).

The essence of blockchain should be to remain neutral to the type of activity.

Building an ecosystem around Memecoin is profitable, so many protocols have seized this opportunity.

In the future, other asset classes, such as Decentralized IoT Networks (DePIN), Real-World Assets (RWAs), stablecoins, and mainstream assets, may gradually replace Memecoin trading volume.

But for now, calling Solana a "Memecoin Economy" is not an exaggeration.

This also means that if Memecoin trading volume experiences a significant contraction, it could trigger a chain reaction of revenue decline.

Why is this important?

Solana's development narrative has always revolved around the growth of fundamental metrics, which have also supported the performance of the $SOL asset.

However, in reality, these metrics are highly dependent on the Memecoin space, which has a strong reflexivity (meaning changes in trading volume will amplify market fluctuations).

If we use these metrics to assess Solana's progress, then a collapse in Memecoin trading volume could turn a "growth story" into a "recovery story."

This would lead to a sharp shift in market sentiment, and restoring these economic activities could take a considerable amount of time.

Of course, it could also be that Murad's viewpoint is correct. If so, then disregard the above concerns.

In the long term, I still remain bullish on Solana's ecosystem. However, in the short to medium term, if Memecoin demand cannot be sustained, Solana's economy may face some challenges.

You may also like

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Leading AI Claude Predicts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways Claude AI projects substantial growth for XRP, Cardano, and Ethereum by the end of 2026, with…

Crypto Price Forecast for 16 February – XRP, Ethereum, Cardano

Key Takeaways Technical trends and recent developments suggest potential growth for XRP, Ethereum, and Cardano. XRP is targeting…

Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

Key Takeaways Recent market movements have sparked concerns over a potential bear market for Bitcoin, marked by significant…

XRP Price Forecast: Can XRP Truly Surpass Bitcoin and Ethereum? Analyst Argues the Contest Has Already Begun

Key Takeaways XRP has maintained significant support around the $1.40 level despite a 12% decline over the past…

Best Crypto to Purchase Now February 6 – XRP, Solana, Bitcoin

Key Takeaways XRP’s Strength: Ripple’s focus on challenging traditional systems like SWIFT is driving XRP towards a potential…

South Korea Intensifies Crypto Market Investigations Following Bithumb Incident

Key Takeaways A $44 billion mishap at Bithumb has prompted South Korean authorities to step up their scrutiny…

BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week

Key Takeaways Bitcoin’s price fluctuations lead traders to eye $50,000 as a critical bottom. Despite a recent rally…

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…