From the Pokémon Scandal to Doubling Trading Volume, Unveiling the Logic Behind Sui's Recent Strong Rally

Original Article Title: "The Multiple Catalysts Behind Sui's Surge: From Pokémon Collaboration Rumors to DEX Trading Volume Spike"

Original Source: PANews

Recently, the Sui governance token and its ecosystem have experienced a notable surge, with the SUI token itself increasing by over 75% in a week, far outperforming the market during the same period. Behind this phenomenon lies a complex interweaving of driving factors, including speculative enthusiasm triggered by market rumors, significant changes in fund flows, and ongoing improvements in the ecosystem's fundamentals. In this article, PANews delves into the funding trends, key news catalysts, on-chain data performance, and potential risks behind SUI's recent surge, aiming to comprehensively interpret the logic behind this ecosystem frenzy.

Exchange Hot Money Influx, Contract Holdings Surge

Looking at the on-chain fund flows in recent months, the changes in Sui's funds are not significant. Over a three-month period, Sui has seen a net outflow of $32 million, which is not a high amount. However, taking a closer look at the changes in on-chain fund flows over the past month and week, Sui's fund flows have changed very little and have not even made it into the top twenty on the public chain.

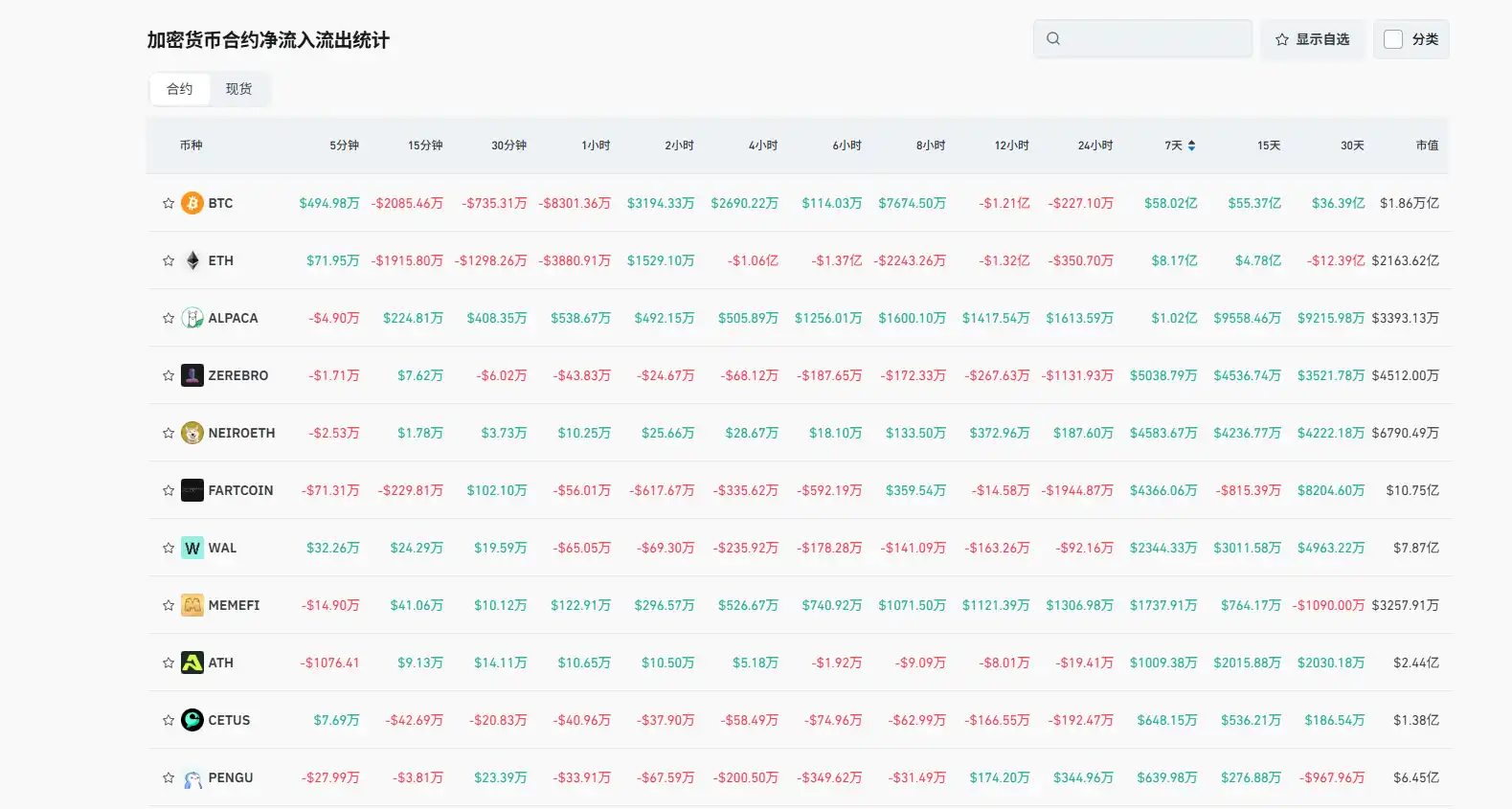

Nevertheless, there has been a noticeable influx of funds from exchanges into the Sui ecosystem. According to Coinglass data, in the last seven days, SUI's spot funding inflow reached $62.86 million, ranking fourth among all currencies, only behind USDT, ETH, and FUSD. In the past seven days, several Sui network ecosystem tokens such as WAL, MEMEFI, and CETUS have also ranked in the top ten for contract funding inflows, further reflecting the ecosystem's funding activity.

In terms of contract holdings data, the SUI token's holdings have experienced a sharp increase since April 21, doubling in just a week from $700 million to $1.419 billion, approaching the previous high of $1.5 billion.

In addition to SUI, most tokens in its ecosystem have also seen significant increases in the past week. Among the Sui ecosystem tokens listed on CoinGecko, 35 tokens have surged by over 100% in the past week, accounting for 20% of the Sui ecosystem projects. 37.5% of the tokens have surged by over 50%, indicating a widespread uptrend.

From a fund perspective, this surge represents a comprehensive collective rise across the Sui ecosystem. While most projects have not seen any actual positive developments, the price movements on the charts have been very apparent.

Multiple Catalysts Boost Market Sentiment

On April 21, almost all major tokens began a synchronous rebound, and Sui's initial rebound also started in line with the overall market trend, followed by a number of positive news releases. However, it is challenging to confirm whether these pieces of news were the true "engine" behind Sui's surge or just "smoke bombs" released to drive up the price.

On one hand, Sui saw several ecosystem partnership announcements. For example, the Pokémon collaboration rumor: This rumor originated on April 23, 2025, when the PokémonHOME app updated its privacy policy, listing "Parasol Technologies" as one of the authorized developers allowed to receive user data. Parasol Technologies is a blockchain gaming studio that was acquired by Sui's core development team Mysten Labs in March 2025. This direct connection quickly sparked the market's imagination, with crypto influencers and social media users speculating that Pokémon may be planning to integrate its IP into the Sui blockchain. The market narrative focused on potential NFT integration or blockchain-based collectibles, and it may even be related to the new "medal" feature launched on PokémonHOME.

It is worth noting that the official blog post from the Sui Foundation on April 23 about Parasol launching a trading card game on Sui did not mention Pokémon. However, some users claimed that an early version of this blog post did mention Pokémon NFTs but was later edited to remove the reference, further fueling market speculation.

Another example is the xMoney/xPortal collaboration: On April 24, Sui announced a partnership with the financial platform xMoney and the crypto super app xPortal. The core of this collaboration is to launch a Sui-branded virtual Mastercard in Europe, integrated within the xPortal app, which has 2.5 million users. Users can add this virtual card to ApplePay or GooglePay and use SUI and other cryptocurrencies to make payments at tens of thousands of merchants, similar to using cash. The physical card is planned to be released later in 2025.

On the other hand, the ETF narrative is also considered a key factor driving Sui's rise. Recently, news of 21Shares establishing the "SUI ETF" statutory trust entity circulated. This news is not actually new as, according to Delaware company registration information, the "21SHARES SUI ETF" statutory trust entity with registration number 10058451 was already established on January 7, 2025, with the registration type being a common law statutory trust. With this news being exposed recently, it also seems to have supported SUI's uptrend.

In addition, the Sui Network has also received a lot of positive news in the past month or two. For example, the Athens Stock Exchange Group announced on April 16 that they had completed the technical design of an on-chain fundraising platform on Sui; Nautilus launched a verifiable off-chain privacy solution for Sui on April 15; Canary Capital submitted an application for a SUI ETF, and so on.

Overall, the recent progress made by Sui in various areas such as Web3 games, privacy, and development environment has come together to form an overall positive outlook. At this point, it is different from the previous single news events that triggered spikes in the market.

Airdrop Event Drives DEX Trading Volume Surge, Facing Dual Pressure of Token Unlocking and Application Development

Since April, the DEX trading volume on the Sui Network has consistently remained at a high level, especially when it hit a historical peak of $9.98 billion on March 29, followed by several days of over $4 billion in daily trading volume. The ecosystem's leading DEX project, Cetus Protocol, drove the overall growth, with its trading volume growing by 84.5% in the past week, and the CETUS token almost doubling in a week.

Another significant contributor is Kriya, on the day when the Sui Network's trading volume broke the record on March 29, Kriya contributed $780 million, accounting for a significant share of the daily trading volume. This data represents a growth of over 100 times compared to the previous day's $7.28 million.

When combined, the surge in trading volume of these two DEXs on March 28 may have been primarily due to the spike in volume caused by Walrus's airdrop. On March 27, Walrus, a decentralized storage project that raised $140 million, conducted an airdrop, and the token's trading volume that day reached $380 million. This may have been a key factor in the recent increase in trading volume on the Sui Network.

Additionally, developer activity is also one of the underlying reasons for Sui Network's growth. On GitHub, the Sui Network's code commits have been relatively frequent recently. Starting from December 2024, the frequency of Sui Network's code commits reached a peak, mostly maintaining over 500 times per week, whereas this data used to be around 250 times. For comparison, Solana and Aptos' code commit frequency is mostly around 100.

However, during the collective market frenzy, there are several risk points that may be worth noting. On the one hand, SUI's token unlocking poses a persistent selling pressure, with millions of tokens being released almost every week, making it the largest supplier in the market. These unlocked tokens are always an untimely bomb in the SUI token's upward cycle.

On the other hand, the rising structure of the Sui ecosystem is currently mainly led by Dex or infrastructure projects, but MEME tokens or application/game projects have not yet shown outstanding performance. At the same time, tokens with a market cap of over 10 million are basically still early-stage projects. From this perspective, if Sui is likened to a city, in this city, a decentralized storage, DeFi, game-themed market has been built around projects such as Walrus, Deepbook, and Parasol. However, these markets currently lack some "internet-famous merchants" to further attract a large number of users to truly enter.

Therefore, the recent surge of the SUI token and its ecosystem is the result of the combined effect of market speculation, capital inflow, and contract market expectations, as well as solid fundamental progress. However, while paying attention to the eye-catching performance of the Sui price, it is also necessary to be vigilant about the continuous selling pressure brought about by token unlocking and to focus on whether its application ecosystem can further prosper and give birth to explosive applications that truly attract users. This will be the key to determining whether Sui can translate its current popularity into long-term value.

Original Article Link

You may also like

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Acquires 18,333,334 qONE Tokens

Key Takeaways HYLQ Strategy Corp has made a strategic investment in qLABS, purchasing over 18 million qONE tokens…

WLFI Crypto Surges Toward $0.12 as Whale Purchase Precedes Trump-Linked Forum

Key Takeaways Whale accumulation has spurred a rally in WLFI crypto prices, reaching towards $0.12 ahead of a…

Cathie Wood Reverses Path with $6.9 Million Purchase in Coinbase Stock – Is ARK Strategizing a Rebound?

Key Takeaways ARK Invest acquires 41,453 shares of Coinbase, showing renewed interest post recent divestment. This acquisition by…

Crypto Lobby Establishes Working Group to Advocate for Prediction Market Regulatory Clarity

Key Takeaways The Digital Chamber announced the Prediction Markets Working Group to promote federal oversight of prediction markets.…

Peter Thiel Discreetly Withdraws from Ethereum Treasury Venture ETHZilla – A Cautionary Note for the DAT Model?

Key Takeaways Peter Thiel and Founders Fund have completely exited their position in ETHZilla. Thiel’s withdrawal raises questions…

Coin Center Advocates Protecting Crypto Developer Liability

Key Takeaways Coin Center is actively lobbying the U.S. Senate to safeguard crypto developer liability protections. The ongoing…

$150B in US Tax Refunds Could Catalyze Fresh Crypto Inflows, Historical Trends Indicate

Key Takeaways The IRS anticipates distributing approximately $150 billion in tax refunds to U.S. consumers by the end…

Oracle Error Leads DeFi Lender Moonwell to $1.8 Million in Bad Debt

Key Takeaways A critical oracle pricing glitch caused Moonwell to incur nearly $1.8 million in bad debt. The…

Crypto Price Prediction Today 18 February – XRP, Solana, Dogecoin

Key Takeaways XRP targets a $5 move, driven by its role as an alternative to SWIFT for cross-border…

China’s DeepSeek AI Predicts the Price of XRP, PEPE, and Shiba Inu By the End of 2026

Key Takeaways DeepSeek AI suggests significant potential price increases for XRP, PEPE, and Shiba Inu by 2026. XRP…

XRP Battles Key Support Amid Grayscale Sentiment Surge

Key Takeaways XRP has experienced a 29% price drop recently, creating a tense atmosphere among traders eyeing key…

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…