Binance's First Public Handling of Insider Trading: How Should the Industry Address Front Running

The term "Insider Trading" seems to be all too common in the trading market, making the permissionless and largely unregulated Crypto space a haven for insider trading, and today Binance released an investigation notice regarding the recent community-discussed case of insider trading involving a Binance Wallet employee in the $UUU token, which marks Binance's first public response to insider information and is a milestone event.

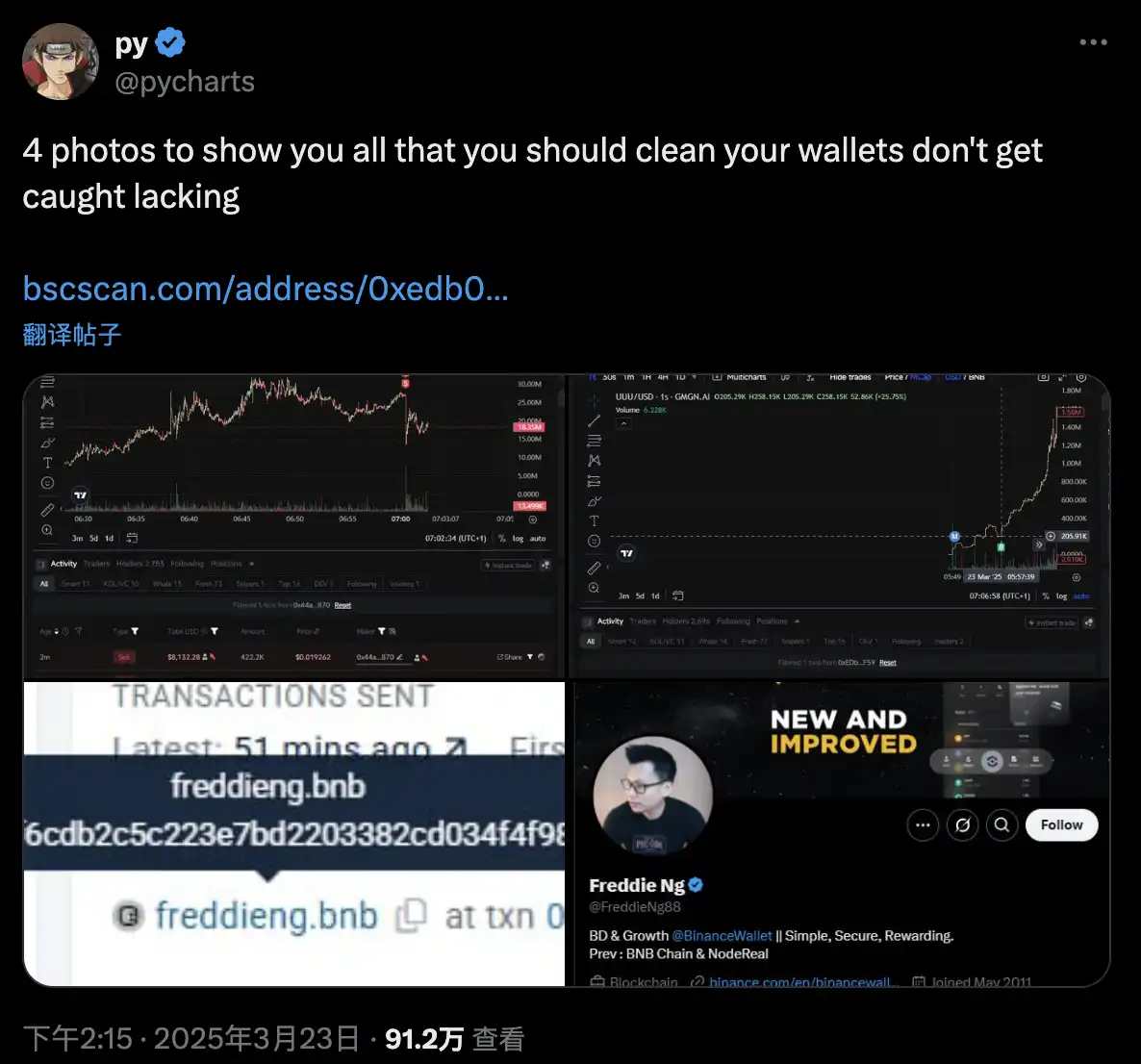

The incident began when Twitter user "pycharts" discovered a related address 0xED...1F59 in the $UUU token issued by uDex in collaboration with Four.meme that was linked to Binance Wallet Business Development personnel Freddie Ng, who "sent funds from freddieng.bnb," and this wallet address purchased 2.4% of $UUU at a low point for $6,227 and sold at a high point to profit $113,000 after transferring to 0x44...8870.

Responding to strong community demands, Binance announced the investigation results in less than 48 hours. According to Binance's announcement, after verification, the involved employee Freddie, who had moved from a BNB Chain business position to the Binance Wallet team a month prior, was suspected of using non-public information about the uDex project's TGE obtained from his previous role to purchase a large amount of $UUU with a related wallet before the project token listing announcement, sold a portion of the tokens after the announcement for profit, and the remaining holdings also showed significant unrealized gains. This behavior constituted insider trading taking advantage of inter-departmental information asymmetry, while also violating Binance's employee rules such as the "5000U Coin Trading Limit" and "90-Day Job Cooling-Off Period." The implicated employee has been suspended, and Binance is cooperating with the relevant legal jurisdiction to initiate legal proceedings, with the related assets being frozen.

Binance's First Public Handling of an Internal Employee

Due to the strong correlation between cryptocurrency value and its application with trading, coupled with on-chain privacy, it's almost inevitable to completely avoid "Insider Trading" behavior, and Binance is not the only trading platform where such behavior has occurred, nor is it the first time "Insider Trading" has emerged. The community has previously reacted to several actions suspected of insider trading, but it couldn't be proven to be related to Binance internally. As the world's largest cryptocurrency exchange, Binance's actions have a significant impact on the industry.

Previously, during a live stream, CZ mentioned that Binance's scrutiny of insider trading is quite strict, having rigorously reviewed over 100 employees in the past few years, of which half were fired, with most individuals' identities not made public. Users entrenched in the cryptocurrency industry are aware that with some basic on-chain knowledge, there are many methods to avoid on-chain identity exposure. If not for this "on-chain" + "off-chain" dual evidence this time, the community might never have known who? How many insiders? How it was handled? And in the imperfectly regulated Crypto space, it's highly likely that there won't be any legal consequences, at most, losing the ability to obtain "insider information" in the future.

Looking back at the rules traditional financial markets have in place to deal with insider traders, the concept originated from the highly integrated and developed investment banking and brokerage business in the United States in the 1970s, where conflicts of interest became increasingly severe. In 1970, the SEC began to require financial institutions to take measures to segregate sensitive information. At that time, the concept of the "Chinese Wall" was widely implemented. It refers to an isolation mechanism established within financial institutions to prevent the leakage of sensitive information between different departments due to conflicts of interest through various measures such as physical isolation, information isolation, transaction restrictions, compliance supervision, training, and penalties.

The prototype of the main character Gordon Gekko in the movie "Wall Street," Ivan Boesky, was fined $100 million for insider trading crimes in the 1980s and sentenced to three years in prison. This case directly prompted a revision of U.S. trading laws. The update of the Insider Trading and Securities Fraud Enforcement Act in 1988 clarified the punishment standards for insider trading and increased the maximum fine for violators. In 2007, Morgan's fund manager, Tang Jian, made a profit of 5 million RMB in the stock market's insider trading case, which also accelerated related industry regulations in China. The "Tang Jian case" led to the inclusion of the crime of "trading using undisclosed information" in the Criminal Law of the People's Republic of China Amendment (VII).

However, in any case, this is the first time Binance has publicly penalized an insider trading employee, and the follow-up handling of this incident will serve as a warning for employees who attempt insider trading in the future.

Can Self-Regulation Be Sustained?

Of course, Binance has already internally established fairly strict rules and regulations to create a "Chinese Wall" within the CEX. However, in a situation where the cost of "crime" is extremely low, such behavior is difficult to prevent. Whether the industry can find a way to balance the limits of "human" desires and community interests becomes crucial.

In addition to disclosing the investigation results in this incident, a reward of $100,000 was evenly distributed to 4 email addresses that reported through the official reporting channels. The announcement did not mention @pycharts, who first "whistleblew" on Twitter, which was also due to the single reporting channel and criteria. Unless there is a neglect of on-chain identity isolation, external parties will find it difficult to obtain direct evidence. The internal system of the trading platform can still be restricted by government regulations that issue local licenses, while affiliated wallets and chain ecosystem practitioners have fewer restrictions.

Similarly, Coinbase, as a top-tier trading platform, may face relatively less public opinion on "insider trading." Apart from being a publicly listed company subject to regulation, it is also related to its internal system. Coinbase strives to ensure the high cost of "insider trading" through a three-stage loop of "prevention-monitoring-punishment."

Coinbase prevents insider trading by implementing a cooling-off period policy (90-180 days trading freeze), a token trading blacklist (prohibition of listing and department-related token trading), and transaction limit restrictions (compliance platform monitoring, explanation required for anomalies).

Furthermore, they carry out on-chain address registration, utilize Chainalysis for monitoring, implement internal system permission layers, conduct behavior analysis and AI alerts (detecting anomalies through email, chat, and transaction data), all to prevent internal employees from accessing insider information sources.

Upon onboarding, mandatory training and agreement signing outlining the consequences of violations, establishment of an anonymous reporting channel (independent platform EthicsPoint providing protection and rewards), and transparent investigation and disclosure (cooperation with the SEC and publicizing results to optimize the process) are all in place to apply maximum criminal cost pressure on insider traders.

As early as July 2022, the SEC and the U.S. Department of Justice charged Coinbase's former product manager, Ishan Wahi, with insider trading involving 25 types of digital assets. Coinbase chose to proactively share the results of the internal investigation and received praise from the Department of Justice at that time. Unlike Coinbase, Binance is not currently a publicly traded company. Instead of sharing investigation results with regulatory agencies, Binance needs to maintain transparency with market participants. After having relatively comprehensive internal systems for prevention and monitoring, the key to industry self-regulation sustainability lies in how to enhance the "penalty" mechanism.

This incident once again sounded the alarm for the industry. While Binance, as a leading exchange platform, has implemented strict regulations to a certain extent, eradicating this human-driven "insider" conduct solely through individual project or entity rules may be challenging. It requires collaborative efforts across the entire industry to achieve.

You may also like

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Leading AI Claude Predicts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways Claude AI projects substantial growth for XRP, Cardano, and Ethereum by the end of 2026, with…

Crypto Price Forecast for 16 February – XRP, Ethereum, Cardano

Key Takeaways Technical trends and recent developments suggest potential growth for XRP, Ethereum, and Cardano. XRP is targeting…

Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

Key Takeaways Recent market movements have sparked concerns over a potential bear market for Bitcoin, marked by significant…

XRP Price Forecast: Can XRP Truly Surpass Bitcoin and Ethereum? Analyst Argues the Contest Has Already Begun

Key Takeaways XRP has maintained significant support around the $1.40 level despite a 12% decline over the past…

Best Crypto to Purchase Now February 6 – XRP, Solana, Bitcoin

Key Takeaways XRP’s Strength: Ripple’s focus on challenging traditional systems like SWIFT is driving XRP towards a potential…

Bitcoin's Big Brother Scythe, a Nasdaq Heist Chronicle

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…