Binance Wallet IDO Survival Report: 10 Projects' Real Data Proves Narrative is More Important Than Traffic?

Original Title: "Real Data from 10 Projects: Binance Wallet IDO Project Survival Report"

Original Source: Klein Labs

In the current phase of Web3's adjustment period, the Initial Token Generation Event (TGE) is no longer just a simple fundraising method but has become a battleground for projects and the market. Especially in the current environment of liquidity contraction and investor confidence crisis, how to launch and in what manner to launch has become a topic that project teams must carefully consider.

IDO is a common form of TGE. From early platforms like Coinlist, many top-tier projects have been born through IDOs. However, as the number of projects has increased, the wealth effect of IDOs has diminished. Every move by Binance also constantly stirs the market's nerves. Since 2025, the Binance Wallet IDO has become the choice for many projects to launch. Its characteristics of "low barriers, high heat, strong traffic" quickly became the market focus, attracting a large number of startups and community attention. But it has also exposed a series of fundamental changes in the new coin market structure, valuation system, and project logic.

However, is this model truly suitable for every project? Which projects can quickly amplify their narrative and complete a cold start through it, and which projects may encounter the dilemma of "opening high and falling low" after the market noise? The Klein Labs Research team conducted systematic data research and structured analysis of 10 Binance Wallet IDO projects that have gone live, attempting to help project teams make smarter decisions from a strategic perspective.

1. Background: What kind of market cycle are we in?

We have clearly observed the evolution of market investment preferences over the past few months:

· Early preference: High valuation + low circulation model (VC-led, short-term speculation)

· Mid-term frenzy: Fully circulating Meme Coin model (zero-threshold hype)

· Current turning point: The market is returning to a focus on strong fundamental and sustainable projects

At the same time, the structure of the TGE model is also undergoing three stages of evolution:

· Early model: Low valuation issuance + market value discovery mechanism (narrative-driven)

· Mid-term Mode: High Valuation Issuance + Insider Arbitrage (Through OTC or Immediate Sell Post Unlock)

· Current Status: Reverting to Low Valuation Opening (Lack of Buying Interest, No One Willing to "Catch the Falling Knife")

This market state is most intuitively reflected in what we see in the Binance Wallet IDO project's low valuation launch. The project must exchange a modicum of market attention for an extremely low valuation and unlock ratio. Behind this is an important logic:

The TGE valuation is not a reflection of "project future value," but a current comprehensive mapping of market liquidity, listing expectations, narrative intensity, and market-making system.

II. Binance Wallet IDO's Traffic Effect Is Still Strong, but Rhythm Control Is Key

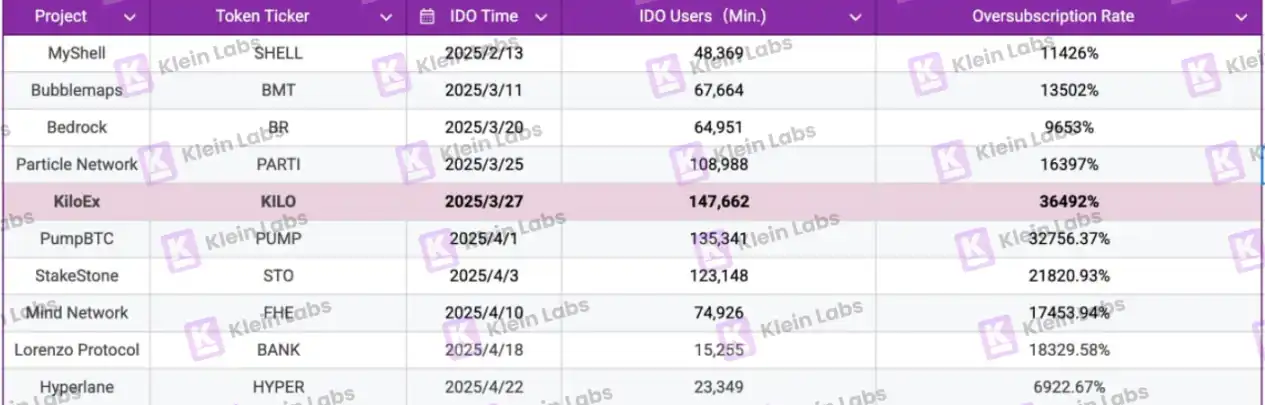

From the data perspective, Binance Wallet IDO has brought significant market attention and brand exposure to projects:

· Average number of participants is 80,965 people;

· Single fundraising ranges from 60,000 to 443,000 BNB;

· Over-subscription rates range from 6,900% to 36,500%.

Among them, KiloEx reached an over-subscription rate of 36,492%.

Binance Wallet IDO easily leverages the attention of hundreds of thousands of users, even in a generally cold market, still attracting tens of millions of dollars' worth of assets. Although with mechanism optimization, the user participation threshold has increased, it can effectively filter out high-quality users with more long-term value and stickiness, bringing a healthier user structure and community foundation to the project team, aiding in subsequent community operations and user conversion.

With the support of the Binance Wallet's light touch mechanism, project teams can still gain strong cold-start momentum, significantly compressing the user acquisition path and cold-start costs.

III. TGE Models Are Being Decentralized, Wallet IDO Projects Are Generally Launching at Low Valuations

Through data analysis, we found that the Binance Wallet IDO projects exhibit a clear commonality in tokenomics:

· IDO stage token release ratios are generally low, ranging from 2% to 5% of total supply, averaging 4.44%;

· The Initial Circulating Supply Ratio during the Token Generation Event (TGE) phase is usually between 20% and 30%, ensuring that the initial market liquidity is not excessively diluted;

· The Fully Diluted Valuation (FDV) corresponding to the IDO phase is between $10 million and $30 million. Overall, this range falls within a relatively reasonable or slightly low valuation range.

During this phase, the project team is still willing to conduct the TGE through a Binance Wallet IDO, considering the following:

· The product is already developed and there is a need to issue tokens to access usage scenarios/incentive systems/settlement systems;

· There is a need to attract community attention and trading support cost-effectively, equivalent to conducting a large-scale marketing campaign to establish liquidity;

· Upholding a long-term vision, accepting a low valuation, low token release, and slow-paced growth.

Projects participating in the current stage of Binance Wallet IDO have to endure the pressure of low valuation due to the market's lack of confidence. However, this situation can also reserve more room for market capitalization growth for excellent projects.

IV. Exchange Performance: Binance Wallet IDO is a Gateway to Binance, Not the Final Destination

In the imagination of many teams, the Wallet IDO signifies "listing on Binance." However, the reality is far from this:

· Binance's spot listing rate is 40% (SHELL, BMT, PARTI, HYPER);

· Approximately 90% of projects land on the Binance Futures market;

· Bybit has a 70% spot listing rate and an 80% contract listing rate;

· The current listing rate on Korean exchanges is relatively low and non-standard.

Binance Wallet IDO does not equate to listing on Binance. The Binance Wallet IDO provides more like a trial ticket to enter Binance's traffic ecosystem. Whether a project can officially enter the spot market depends on the post-listing data performance, user feedback, and Binance's internal evaluation by the trading team. Project teams should consider it as a "pre-show before the main stage" and prepare adequately for listing and secondary liquidity support.

V. Price Trend: Strong Start, Long-term Performance Depends on Operations and Market Strategy

Based on the current data, most Binance Wallet IDO projects have performed well on the first day, with a generally impressive Return on Investment (ROI):

· PumpBTC saw a first-day price increase of up to 760%, and KiloEx's ROI performance was similarly remarkable.

· Although there was significant price volatility on the first day, the project's medium- to long-term performance depends more on continuous operational capability, market management strategy, and a clear long-term development plan.

· It is worth noting that some projects (such as MyShell, Bubblemaps, PumpBTC) have chosen to actively expand into the Korean market post-IDO to drive future growth.

While Binance Wallet IDO projects often experience initial hype, if the project lacks long-term planning, it will struggle to withstand the multiple challenges present in the current market environment—such as weak buying pressure, investors no longer chasing short-term liquidity, insufficient medium- to long-term fundamental support, and premature depletion of narrative value. Against this backdrop, there has been a gradual divergence in the market performance of different projects.

Short-term hype may be easy to come by, but what truly determines whether a project can go the distance is still continuous operational capability and market management strategy. Project teams need to plan the control rhythm of the secondary market and investor relations management in advance to avoid rapid price drops and achieve the steady release of long-term value.

VI. Trading Heat Performance: A True Reflection of Market Attention and Capital Momentum

The market performance of Binance Wallet IDO projects varies by project, but overall, the trading heat is generally high:

Projects like PARTI, BMT, and BR have stood out, with first-day trading volumes exceeding $20 million each

The high trading volume is not only related to initial traffic but also closely linked to the project's narrative strength, tokenomics design, and market expectation management;

IDO is just the "ignition point" of hype, and whether it can maintain the hype and ignite the secondary market depends on the project's overall execution and operational rhythm control. Many underperforming projects quickly fell silent post-TGE, either due to a lack of sustained content output to maintain topic relevance or due to out-of-control market management leading to rapid confidence decline.

Conclusion: Binance Wallet IDO is a "value filter" and a narrative validation

Binance Wallet IDO is a structured, high-leverage cold start method that is currently used by Web3 projects to kickstart their narrative, build consensus, and amplify attention. It provides project teams with a playbook for leveraging a large volume of noise at a low cost, but it also places a strong emphasis on the team's execution, operational planning, and marketing management capabilities.

The data performance of Binance Wallet IDO reflects a profound evolution in the market's valuation logic and issuance model. It is not the end point, nor is it a pass, but rather a window through which a product vision can be validated at low cost and market mechanisms can be trialed.

It is precisely because the market is currently in the late stage of low confidence, low liquidity, and high caution that there is a greater need for projects that are truly committed to long-term development to come forward and use the Binance Wallet IDO to showcase their product value, narrative pace, and operational capabilities.

It is not suitable for everyone, but for those teams with a clear story, defined pace, and long-term development intentions, it is an important springboard to enter the Binance ecosystem and mainstream market visibility. In the window of time when the bubble bursts, the market returns to the essence of value. This is actually a positive signal for teams that truly want to make things happen and have long-term vision.

Like all platform-based IDOs, after the brief joy, how can the feast continue? This is also a question that Binance Wallet needs to consider. Simply put, if Binance Wallet IDO can continue to be the preferred launch platform for quality assets, then its lifecycle can be extended as much as possible. Behind this is the understanding of "quality assets." What projects does the industry really need? Which projects are suitable for development in this world? Each and every one of us needs to think deeply about this.

This article is contributed content and does not represent the views of BlockBeats.

You may also like

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Acquires 18,333,334 qONE Tokens

Key Takeaways HYLQ Strategy Corp has made a strategic investment in qLABS, purchasing over 18 million qONE tokens…

WLFI Crypto Surges Toward $0.12 as Whale Purchase Precedes Trump-Linked Forum

Key Takeaways Whale accumulation has spurred a rally in WLFI crypto prices, reaching towards $0.12 ahead of a…

Cathie Wood Reverses Path with $6.9 Million Purchase in Coinbase Stock – Is ARK Strategizing a Rebound?

Key Takeaways ARK Invest acquires 41,453 shares of Coinbase, showing renewed interest post recent divestment. This acquisition by…

Crypto Lobby Establishes Working Group to Advocate for Prediction Market Regulatory Clarity

Key Takeaways The Digital Chamber announced the Prediction Markets Working Group to promote federal oversight of prediction markets.…

Peter Thiel Discreetly Withdraws from Ethereum Treasury Venture ETHZilla – A Cautionary Note for the DAT Model?

Key Takeaways Peter Thiel and Founders Fund have completely exited their position in ETHZilla. Thiel’s withdrawal raises questions…

Coin Center Advocates Protecting Crypto Developer Liability

Key Takeaways Coin Center is actively lobbying the U.S. Senate to safeguard crypto developer liability protections. The ongoing…

$150B in US Tax Refunds Could Catalyze Fresh Crypto Inflows, Historical Trends Indicate

Key Takeaways The IRS anticipates distributing approximately $150 billion in tax refunds to U.S. consumers by the end…

Oracle Error Leads DeFi Lender Moonwell to $1.8 Million in Bad Debt

Key Takeaways A critical oracle pricing glitch caused Moonwell to incur nearly $1.8 million in bad debt. The…

Crypto Price Prediction Today 18 February – XRP, Solana, Dogecoin

Key Takeaways XRP targets a $5 move, driven by its role as an alternative to SWIFT for cross-border…

China’s DeepSeek AI Predicts the Price of XRP, PEPE, and Shiba Inu By the End of 2026

Key Takeaways DeepSeek AI suggests significant potential price increases for XRP, PEPE, and Shiba Inu by 2026. XRP…

XRP Battles Key Support Amid Grayscale Sentiment Surge

Key Takeaways XRP has experienced a 29% price drop recently, creating a tense atmosphere among traders eyeing key…

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…